Banking & Finance

How Wema Bank Incurred N8 Billion In Court Cases, Lost N239.920M To Fraudsters Over Security

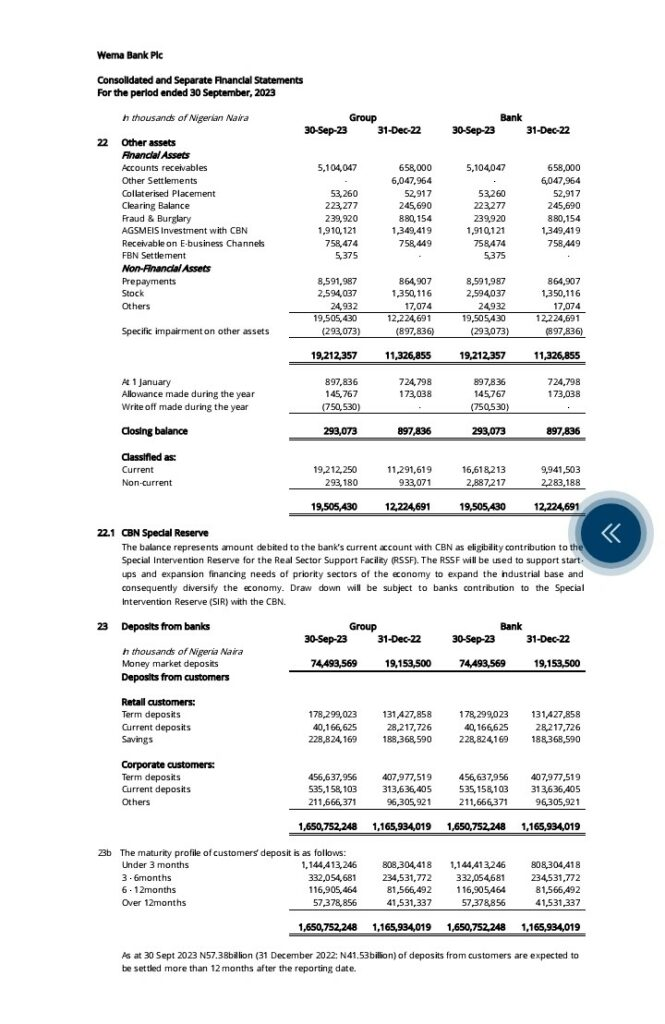

Wema Bank has brought upon itself N8.067 billion in court litigation as of September 2023 and also forfeited about N239.920 million to fraud and forgery as of the end of September 2023.

BrandNewsDay reports that Moruf Oseni-led Wema Bank made this known in its recently released financial statement to the Nigerian Exchange Group.

However, the litigation claims represent only 3.2 per cent of N8.331 billion reported in December 2022.

On a similar note, the Nigerian Bank’s fraud and burglary losses in the third quarter of 2023 represent a 73 per cent reduction from a loss totalling N880.154 million recorded in the corresponding period of 2022.

This shows that Wema Bank achieved of cutting down its fraud cases between month intervals. This was characterised by its increased technology spending, which rose by 31 per cent from N1.421 billion in September 2022 to N1.856 billion by September 2023.

Wema Bank Court cases

.

According to Wema Bank, “These litigations arose in the normal course of business and are being contested by the Bank. The Directors, having sought the advice of professional counsel, are of the opinion that

no significant additional liability will crystallise from these claims; other than as recognised in these financial.”

In a similar development, some aggrieved customers and parties initiated 932 court cases against Guaranty Trust Bank (GTB), also known as Guaranty Trust Holding Company PLC (GTCO), in the first six months of 2023.

According to Economy Post learnt from the bank’s half-year 2023 financial statements released to the Nigeria Exchange Group, the litigants were demanding N595.9 billion and $24.05 million in damages and refunds from the Tier-1 bank.

There are many reasons why either banks or customers initiate court cases. A lawyer, Dr Sam Oyigbo, explained that fraud and violations of contractual terms could lead to litigations.

“Banks and customers have contractual relationships. If there is a breach of contract or inability to resolve through alternative resolutions, either of the parties can go to court,” he said.

“If you prepare a cheque and the bank fails to honour it, you can go to court. If you wrongfully make a payment, you can go to court to get an order of reversal. The documents customers sign at banks are very critical. So, customers must read them carefully before appending their names. However, when something happens between customers and banks, the court will look at the circumstances surrounding it, irrespective of the documents signed by the bank.

“Similarly, the banks can sue their customers if they fail to repay loans. They can also do so when there is a breach of an agreement or someone tries to bring a bank into disrepute,” Oyigbo further said.

Another lawyer, Ms Deborah Nyang, explained that some banks were facing court cases from customers due to the loss of funds to fraudsters.

“This happens especially when there is a loss of money in the bank account of someone who does not have an ATM card or does not do online banking. Should you lose your money through online sources, you can sue the bank. Also, the banks could sue customers for breach of agreement, fraudulent practices or activities that could cost the bank some goodwill,” she added.

A financial analyst, Mr Ike Abununo, however, urged banks to begin to resolve matters quickly with customers, stressing that why several cases would go to court because banks were failing to attend to customer complaints.

“If a bank fails to attend to a customer’s complaints or does not act in a manner that shows that it cares, people will be forced to litigate. Banks must change their strategies and learn to solve customer issues as quickly as possible. They must remember that without customers, there will be no bank.”

Meanwhile, Wema Bank’s spokesperson, Ms Mabel Adeteye, did not respond to Economy Post‘s inquiries via WhatsApp messages seeking clarifications on the bank’s fraud issues.