Business & Economy

Bearish Sentiment In Domestic Bourse, NGX ASI Dips 7bps

At the end of yesterday, Wednesday’s trading session, the Nigerian All Share Index closed in red, dropping by 0.07% to close at 52,721.34 points.

BrandNewsDay reports that the Nigerian All Share Index Wednesday’s performance was due to sell-offs in large-cap stocks such as WAPCO (-2.41%) and NGXGROUP (-4.58%). Consequently, the YTD return decreased to 23.42% as market capitalisation decreased by ₦19.02 billion to close at ₦28.42trillion.

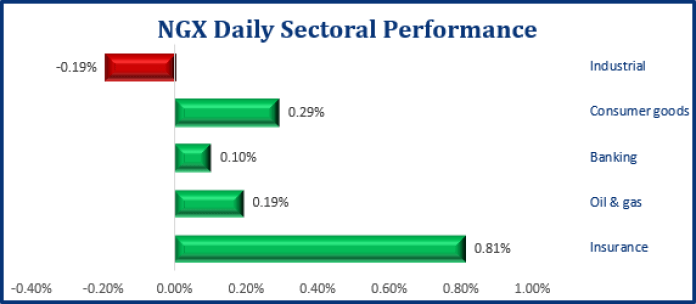

The sectoral performance strengthened as four of the five indices under coverage advanced. The Insurance index, the biggest gainer, rose by 0.81% on MANSARD (+4.55%).

RECOMMENDED: Disney+ Welcomed To South Africa, Reveals Standard Pricing At Launch

The Consumer goods, Oil & Gas and Banking Indices, followed suit, rising by 0.29%, 0.19% and 0.10%, on PZ (+1.89%), OANDO (+1.30%) and ZENITH BANK (+1.24%) respectively. Conversely, the Industrial Index, the sole loser, fell by 0.19% on WAPCO (-2.41%).

Bearish Sentiment In Domestic Bourse, NGX ASI Dips 7bps

Investors’ sentiment strengthened but was negative as the market breadth increased to 0.87x from 0.77x. This was illustrated by the decline of 23 stocks, led by ACADEMY (-9.20%) and BERGER (-8.39%) and the advance of 20 stocks, led by MCNICHOLS (+9.94%) and TRANSCOHOT (+9.84%). Activity level was weakened as the total volume and value decreased by 53.77% and 3.86% respectively, as investors exchanged about 611.97mn units of shares worth over ₦7.43bn.

We expect negative sentiment to persist on the back of profit-taking on stocks that have appreciated significantly

Nigerian All Share Index

Domestic Bourse

Fixed Income

There was mixed sentiment across the bond yield curve as two of the four bond yields under coverage inched higher, the FGN-APR-2023 bond paper closed flat while the FGN-JUL-2030 bond paper compressed by 11bps. The yields on the FGN-MAR-2024 and FGN-JAN-2026 bond papers increased by 1bp and 8bps respectively.

Treasury bill yields for the 91, 182 and 364-day bond papers closed flat at 2.99%, 3.61% and 4.86% respectively.

We expect market activity to be influenced by the liquidity levels and foreign investors’ participation.

Market Snapshot

- Bearish Sentiment in the Domestic Bourse, NGX ASI Dips 7bps

- Mixed Sentiment across the Bond Yield Curve

- Negative Performance in Global Stocks

- Commodities Market Closes in Red

- Negative Performance in African Stocks